does idaho have inheritance tax

Even though Idaho does not collect an inheritance tax however you could end up paying inheritance tax to another state. The inheritance tax is a tax on the beneficiarys gift.

Proposed Inheritance Tax Changes Would Be Devastating For Family Farms Study Shows Spudman

It is one of 38 states in the country that does not levy a tax on estates.

. Idaho does not levy an inheritance tax or an estate tax. Idaho does not levy an inheritance tax or an estate tax. You would not need to pay any federal income tax on the inheritance.

The top inheritance tax rate is18 percent exemption threshold. And although the Federal Gift Tax applies. There is no estate tax in Idaho.

However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. But certain inheritance laws in other states could be applicable. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Page last updated May 21 2019. How Long Does It Take to Get an Inheritance. The inheritance tax is a tax on the beneficiarys gift.

Since this state doesnt collect its own inheritance tax you likely wont have to pay anything. Also gifts of 15000 and below do not require any tax payment or estate tax return. Idaho has no gift tax and it is the most efficient and straightforward tool to reduce the taxable part of your estate.

Idaho does not have an estate or inheritance tax. Mortgage Calculator Rent vs Buy. No estate tax or inheritance tax.

However like all other states it has its own inheritance laws including the ones that cover what. Even though Idaho does not collect an inheritance tax however you could end up paying. Up to 15 cash back No.

Estates and Taxes Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. More good news for you Idaho does not impose an inheritance tax. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660.

Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Keep in mind that if you inherit property from another state that state may have. On the one hand Texas does not have an inheritance tax.

In 2022 the threshold will increase to 12060000. Last full review of page. This number doubles for a married couple and becomes 2412 million.

For more details on Idaho estate tax requirements for deaths before Jan. There is a federal estate tax that may apply. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. In other words the estate itself can be taxed for the amount that is above the exemption cut-off. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Idaho also does not have an inheritance tax. Gifting away shares of your property to heirs presumptive you can protect up to 1206 million worth of heirdom.

The beneficiary of the property is responsible for paying the tax him or herselfânot the estate. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. 952 White Plains NY 10606.

So if you placed this money in a bank and earned 500 interest income tax would need to be paid on the 500. All Major Categories Covered. States With an Inheritance Tax and an Estate Tax.

This increases to 3 million in 2020 Mississippi. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. You can however breathe a little easier as there are now only eight states that impose an inheritance tax Indiana Iowa Kentucky Maryland Nebraska New Jersey Pennsylvania and Tennessee.

Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. No estate tax or inheritance tax. Section 15-2-102 permits a surviving spouse to inherit the decedents entire estate if the decedent did not have children and her parents are deceased.

However you would need to pay federal income tax on the income generated by the 47000. So it really depends on where the beneficiary lives and where the estate assets are. Federal and State EstateInheritance Taxes There is a federal estate tax but not everyone pays it.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. No estate tax or inheritance tax. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income.

According to the IRS an estate tax filing is required for estates with combined gross assets and prior taxable gifts exceeding 11700000 in 2021. Right now there are 6 states that have an inheritance tax. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660.

Idahos capital gains deduction. Select Popular Legal Forms Packages of Any Category. However if the person whom youve inherited money possessions or property from lives in a state that does collect an inheritance tax youll be required to pay it alongside the federal estate tax.

The US does not impose an inheritance tax but it does impose a gift tax. You must complete Form CG to compute your Idaho capital gains deduction. The gift tax exemption mirrors the estate tax exemption.

The top estate tax rate is 16 percent exemption threshold. Idaho does not currently impose an inheritance tax.

Focus Shifts To State Estate Tax Planning Wsj

6 Frequently Asked Questions About Idaho Estate Law Planning Mzj

Bizmojo Idaho Gobankingrates Com Gives Idaho Some Good Press Again

Capital Gains Tax Calculator 2022 Casaplorer

Cost Of Living In Idaho The True Cost To Live Here Upnest

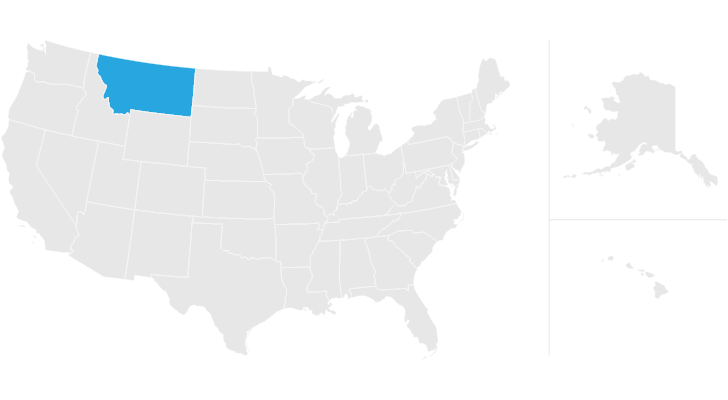

How To Create A Living Trust In Montana Smartasset

Estate Tax Rates Forms For 2022 State By State Table

What Is Inheritance Tax Probate Advance

6 Frequently Asked Questions About Idaho Estate Law Planning Mzj

Idaho Wills And Trust Requirements

What Is Inheritance Tax Probate Advance

Tax Burden By State 2022 State And Local Taxes Tax Foundation

6 Frequently Asked Questions About Idaho Estate Law Planning Mzj

Does Tax Season Have You Thinking About Estate Taxes Coeur D Alene Press

Where S My State Refund Track Your Refund In Every State