child tax credit 2021 dates and amounts

31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per. Our Mission Is to Make Sure You Get the Information You Need from an Informed Decision.

Slash Your 2021 Tax Bill With These Last Minute Moves

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Last year the tax credit was also fully refundable. 3600 for children ages 5 and under at the end of 2021.

15 opt out by Aug. Find COVID-19 Vaccine Locations With. 15 opt out by Nov.

Take our free 30 second eligibility quiz for up to 26kemployee. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

By August 2 for the August. For children under 6 the amount jumped to 3600. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids.

Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont. For 2022 that amount reverted to 2000 per child dependent 16 and younger. The amount changes to 3000 total for each child ages six through 17 or 250 per month and 1500 at.

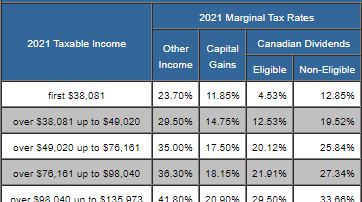

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Take our free 30-second quiz. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021.

112500 for a family with a single parent also called Head of Household. How to unenroll or opt out from advance Child Tax Credit payments this does not apply as of Dec. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Child Tax Credit amounts will be different for each family. Children who are adopted can.

Children who are adopted can also qualify if theyre US citizens. 15 opt out by Oct. Alberta child and family benefit ACFB All payment dates.

The IRS bases your childs eligibility on their age on Dec. Ad Unsure if you qualify. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

When you file your 2021 tax return you can claim the other half of the total CTC. To reconcile advance payments on your 2021 return. 3000 for children ages 6 through 17 at the end of 2021.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of. Want to learn more. Learn more about the Advance Child Tax Credit.

That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. The payment for children. Enter your information on Schedule 8812 Form.

You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. 15 opt out by Nov. 150000 for a person who is married and filing a joint return.

For other tax years it is partially refundable. Your amount changes based on the age of your children. 29 What happens with the child tax credit payments after December.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. For children under the age of 6 the maximum credit equals 3600 annually or 300 per month. 13 opt out by Aug.

The American Rescue Plan institutes a fully refundable Child Tax Credit for 2021 increasing the maximum amount eligible parents can receive for simply having a qualifying child dependent to 3000 per child ages 6 to 17 per year or 250 per month. 15 opt out by Nov. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Get your advance payments total and number of qualifying children in your online account. The 2021 Child Tax Credit or CTC is a fully refundable tax credit for qualifying individuals. New 2021 Child Tax Credit and advance payment details.

If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. ERTC advances are possible in 2-4 weeks. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

It is fully refundable for 2021 only. This 2021 Child Tax Credit calculator not only informs you if a person qualifies as a dependent on your 2021 Tax Return but also if you qualify. The 500 nonrefundable Credit for Other Dependents amount has not changed.

Ad Usafacts Is a Non - Partisan Online Source for the Most Up-to-date Data and Research.

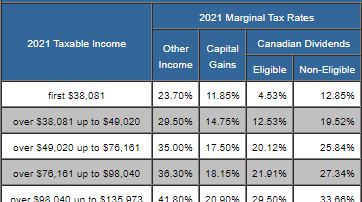

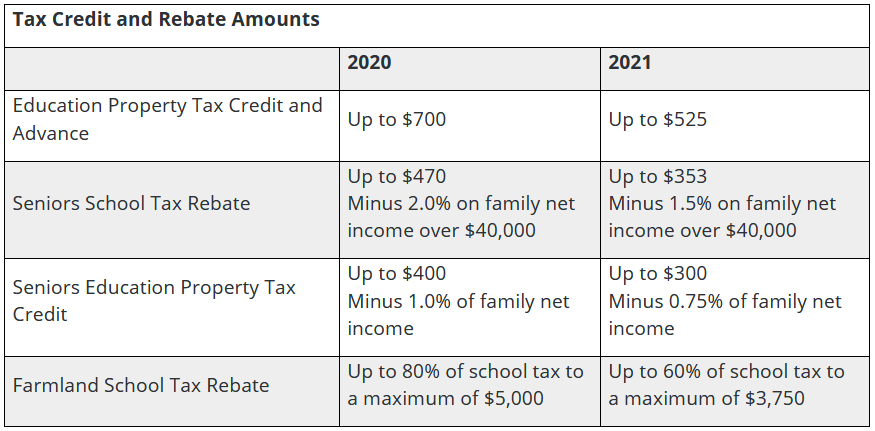

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

Insurance Premium Tax Benefits Life Insurance Premium Income Tax Return File Income Tax

Taxtips Ca Newfoundland And Labrador 2020 2021 Personal Income Tax Rates

Here S Who Qualifies For The New 3 000 Child Tax Credit

Don T Lose Money By Not Filing A Tax Return Taxes Taxrefund Tax Refund Tax Return Lost Money

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Child Tax Credit Payments May Boost Retail Sales As Soon As This Month

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

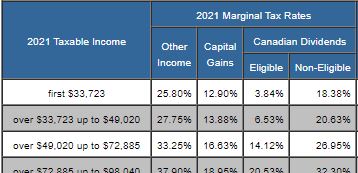

Personal Income Tax Brackets Ontario 2021 Md Tax

Canadian Tax News And Covid 19 Updates Archive

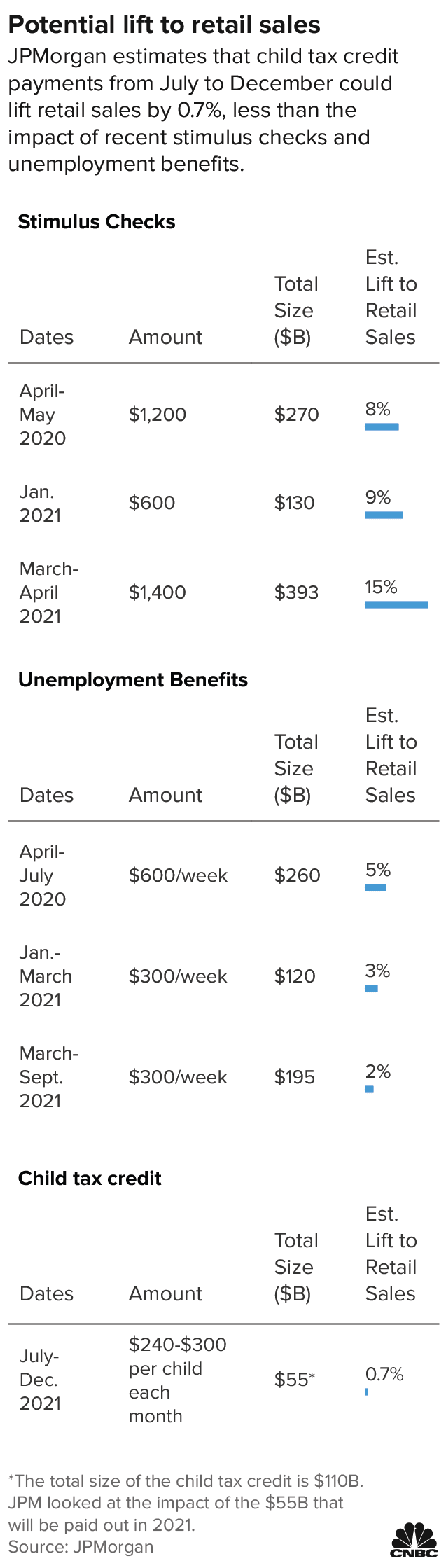

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Taxtips Ca Manitoba 2020 2021 Personal Income Tax Rates

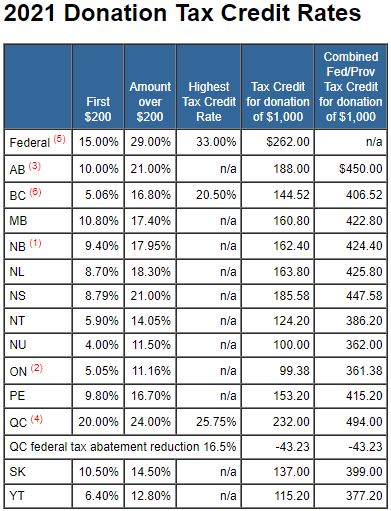

Taxtips Ca Donation Tax Credit Rates For 2021

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips